2025 Section 179 Deduction for Generators & Heavy Machinery

Learn how the Section 179 tax deduction can help your business save thousands on new or used heavy equipment and commercial generators.

Unlock Major Tax Savings on Your Next Equipment Purchase

Discover how Section 179 of the IRS tax code allows you to immediately deduct the full purchase price of qualifying equipment, turning a major expense into a powerful tool for growth.

Jump to:

Calculate Your Savings

Section 179 Deduction Calculator

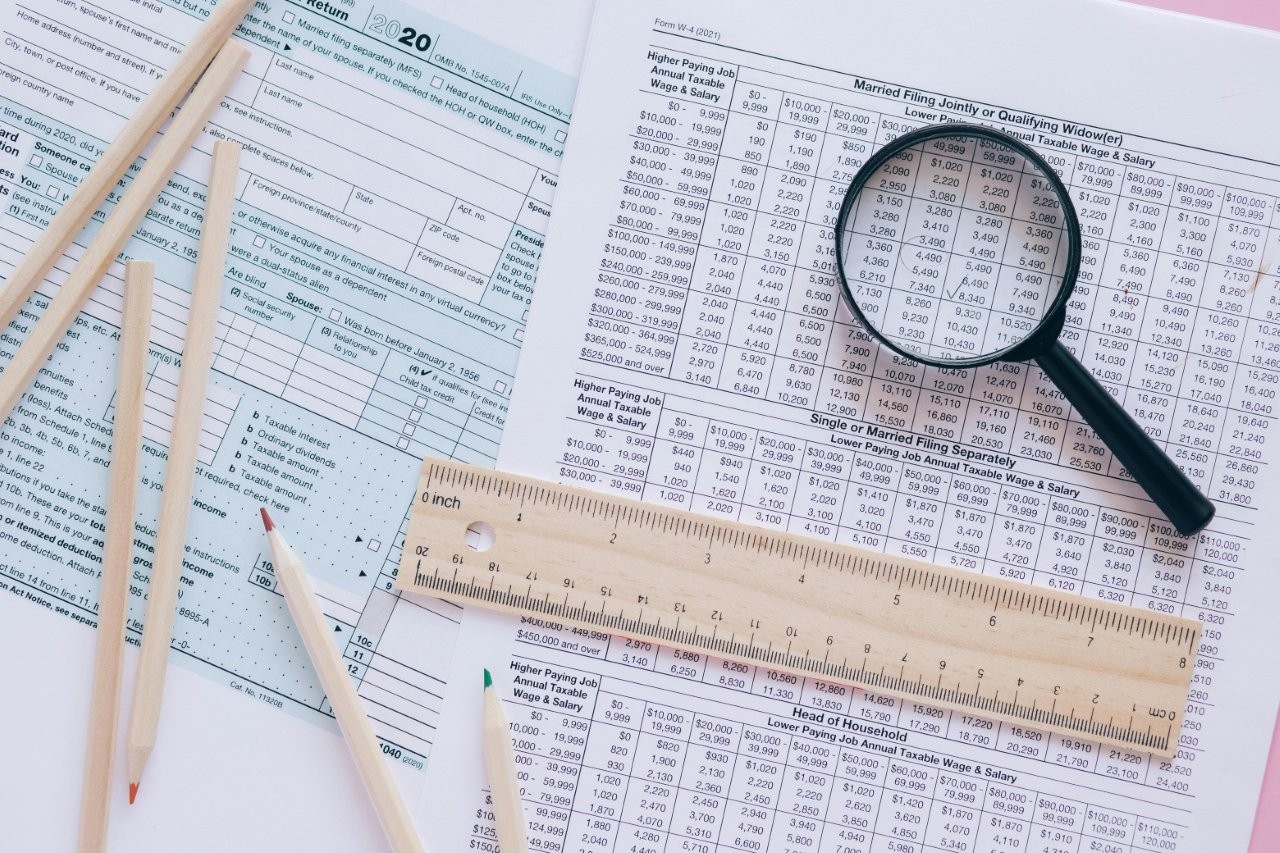

2025 Section 179 Calculator

This tool provides an estimated tax scenario using common assumptions that may not fit your specific business situation. It is not professional tax advice. Please reach out to your tax professional to understand the tax implications of purchasing equipment or software for your business.

What is the Section 179 Deduction?

In simple terms, Section 179 is a tax incentive designed to encourage small and medium-sized businesses to invest in themselves.

Instead of depreciating the cost of an asset over many years, Section 179 allows you to treat the entire purchase price as an expense and deduct it from your gross income in the same year you buy it. This significantly lowers your taxable income, resulting in substantial cash savings that you can reinvest back into your business.

It’s a direct, powerful, and immediate way for the government to help you pay for the new or used equipment you need to grow.

How Section 179 Works: A Simple Example

Let’s break down the core concept without using specific annual limits, which can change.

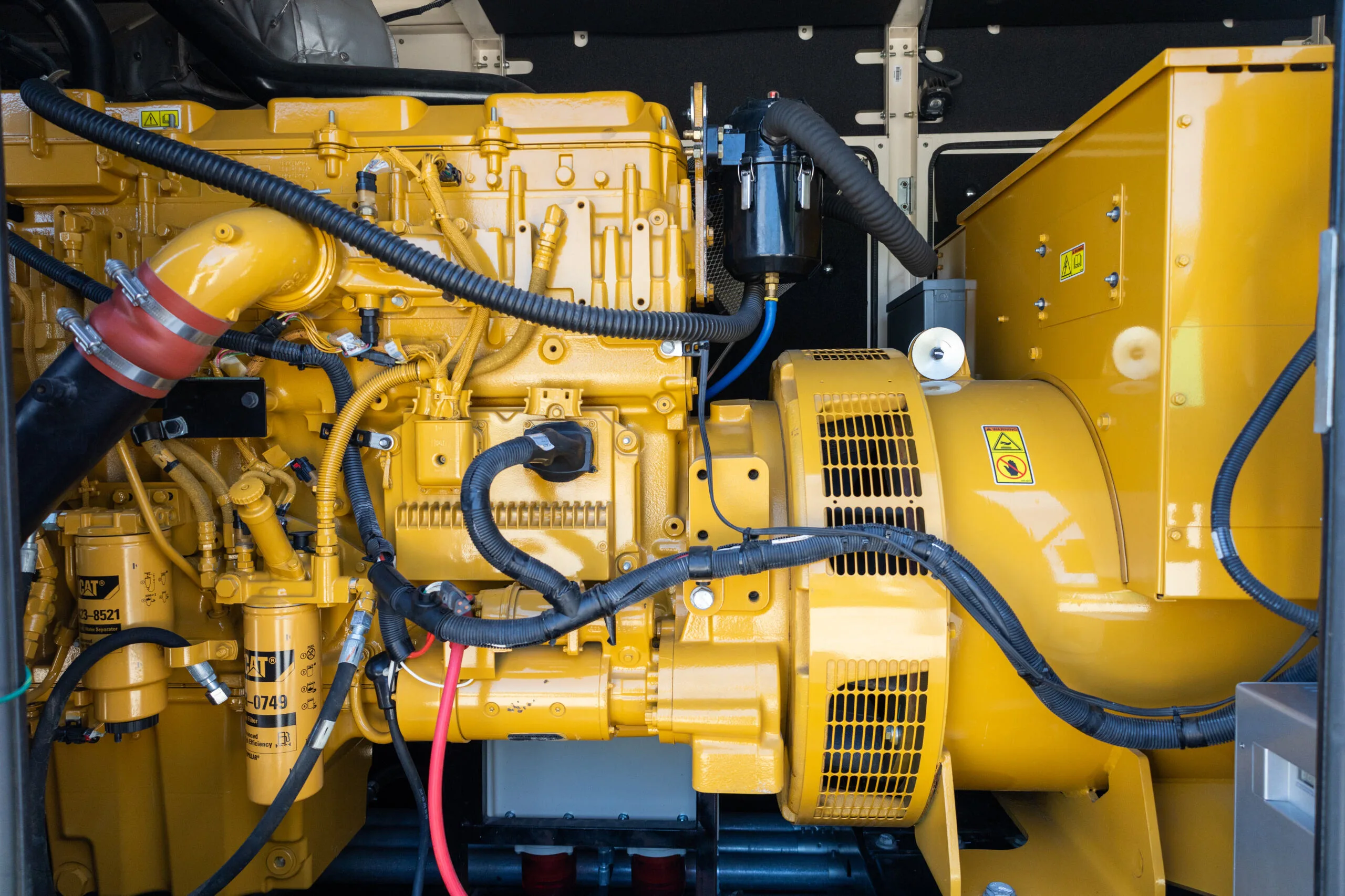

- You Need Equipment: Your business needs a new backup generator. You find the perfect model and purchase it.

- You Elect to Take the Deduction: When you file your taxes for the year, you elect to take the Section 179 deduction for the full cost of that generator.

- You Lower Your Taxes: The full cost of the generator is subtracted from your business’s profit, lowering your taxable income. A lower income means a lower tax bill, leaving more cash in your pocket.

This immediate deduction is far more beneficial than slowly writing off a small fraction of the asset’s value each year for five or seven years.

What Equipment Qualifies for Section 179?

The list of qualifying property is broad, but it perfectly covers the needs of industrial and commercial businesses. To qualify, the equipment must be purchased (or financed) and placed into service during the tax year.

Key Qualifying Equipment Includes:

- Heavy Equipment: Bulldozers, forklifts, excavators, etc.

- Power Generators: Standby, prime, and mobile generators (diesel and natural gas).

- Business Vehicles: Heavy-duty trucks, vans, and other vehicles over 6,000 lbs. GVWR.

- Manufacturing & Production Machinery.

- Computers & “Off-the-Shelf” Software.

- Office Furniture & Equipment.

Critically, both new and used equipment qualify for the Section 179 deduction, giving you maximum flexibility.

Section 179 vs. Bonus Depreciation

You’ll often hear “Bonus Depreciation” mentioned alongside Section 179. While they both help you accelerate depreciation, they have a key difference:

- Section 179 is a targeted deduction with an annual spending cap. If you spend over a certain amount on equipment in a year, the deduction starts to shrink.

- Bonus Depreciation is for businesses of all sizes and has no spending cap. It allows you to deduct a percentage of the remaining cost after taking the Section 179 deduction.

Businesses typically use Section 179 first, up to its limit, and then apply Bonus Depreciation to the remaining amount. Working together, they can often allow you to write off 100% of your equipment cost in the first year.

Frequently Asked Questions (FAQs)

- Can I use Section 179 on a financed or leased generator? Yes! This is one of the best parts. The deduction is available even if you finance the equipment. You can deduct the full price of the generator before you’ve even made all your payments, which can often make your tax savings greater than your first year’s payments.

- Does used equipment qualify? Absolutely. As long as the equipment is “new to you,” it qualifies.

- Does my business need to be profitable to use the deduction? Yes. The Section 179 deduction cannot be used to create a net loss for your business. You can only deduct up to the amount of your net taxable income.

Ready to See This Year’s Numbers?

Tax laws, deduction limits, and bonus depreciation rates are updated annually. We break down the exact numbers and provide a savings calculator on our annual guide.

Related Tax Articles & Case Studies

Industrial Generator Total Cost of Ownership and ROI

Buying a generator is step one. The value shows up when the unit starts on demand, carries your load…

The Administration’s Fuel Plans: What They Mean for Industrial Generator Users

The U.S. administration’s recent push to ramp up fossil fuel production is poised to shake up the en…

Take Advantage Of The Tax Code!Use The Section 179 Deduction & Save On Your Industrial Generator Purchases

What is Section 179?Section 179 allows businesses to deduct the full cost of capital assets (such as…

Let’s Connect

Whether you’re curious about our current inventory, exploring rental options, or need guidance in servicing your generator, we’ve got you covered. Send us a message, and we’ll get back to you promptly.

Fill out our form or call 877-866-6895 to connect with us today!

FAQ

Can I use Section 179 on a financed or leased generator?

Yes! This is one of the best parts. The deduction is available even if you finance the equipment. You can deduct the full price of the generator before you’ve even made all your payments, which can often make your tax savings greater than your first year’s payments.

Does used equipment qualify?

Absolutely. As long as the equipment is “new to you,” it qualifies.

Does my business need to be profitable to use the deduction?

Yes. The Section 179 deduction cannot be used to create a net loss for your business. You can only deduct up to the amount of your net taxable income.