As we continue to move through the third quarter of 2025, a deep dive into the industrial power market reveals clear trends driven by a growing need for operational resilience. This month’s analysis highlights the key sectors, applications, and technical specifications that are defining demand and shaping the future of backup power.

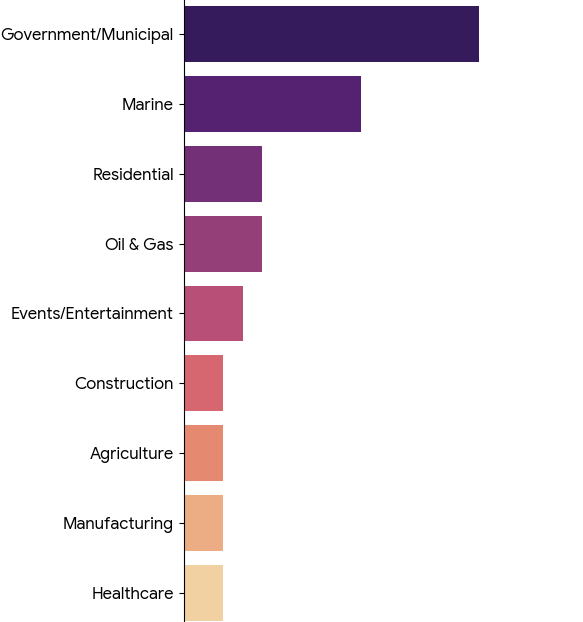

Trending Industries

Critical Infrastructure Investments Surge

Demand is being led by sectors where uninterrupted power is non-negotiable. Government, Municipal, and Marine operations are at the forefront of this investment surge, highlighting a strategic push towards grid independence and fortified infrastructure. We’re seeing this pattern mirrored in other critical areas like Oil & Gas and Healthcare, where the cost of downtime is simply too high to risk. This indicates a broad, strategic shift towards securing essential services against all contingencies.

The Primacy of Preparedness

The strategic focus on operational preparedness is clear, with a significant emphasis on Standby and Backup power solutions. This reflects a mature understanding in the market that emergency power is a fundamental component of any serious continuity plan. Alongside permanent installations, a strong demand for Rental and Mobile/Portable units points to the dynamic needs of project-based industries and event services that require flexible, temporary power on demand.

Demand Concentrates In the Mid-Range

While power requirements span the full spectrum, the market shows a significant concentration of demand in the 150kW to 500kW range. This versatile “sweet spot” addresses a wide array of commercial and industrial applications, from manufacturing lines to mid-sized data centers. At the lower end, the high frequency of demand for 20kW units signals a robust market for smaller, adaptable generators for localized power needs.

Trusted Brands Retain Market Dominance

In conversations about reliability and performance, established industry leaders continue to dominate customer confidence. Caterpillar and Cummins remain the most recognized names, a testament to their long-standing reputation for engineering excellence. The continued strong showing for brands like MTU and Detroit illustrates that while the market values innovation, it ultimately rewards proven performance and dependability.

Technical & Application Trends

1. The Market Demands Custom & Application-Specific Solutions

- The era of one-size-fits-all power solutions is fading. Today’s projects require equipment precisely tailored to unique operational needs.

- The need for mobile generators is expanding to cover evolving properties, such as those that begin with a fifth wheel and later develop into a permanent home.

- For international projects, specialized units like 500KW open skid models are in demand for export.

- Fuel type is a critical design consideration, with a notable market for both natural gas and dual-fuel propane units.

- Brand history and performance are influencing purchasing decisions, leading some clients to seek alternatives to specific manufacturers based on past experiences.

2. Specialized Power is Essential for Diverse Industries

- Growth in key commercial sectors is driving the need for tailored power solutions that can withstand unique environmental and operational demands.

- The agricultural sector shows a consistent need for specific power outputs, such as 20-kilowatt units to run 10-horsepower irrigation pumps.

- The marine industry continues to require robust, outdoor-rated equipment, including three-phase 200KW generators for challenging dry dock environments.

3. Multi-Generator Strategies Are On the Rise

- For complex sites, a more sophisticated approach to power strategy is becoming common to ensure both efficiency and full operational resilience.

- A key trend is the implementation of a dual-generator strategy: using a smaller unit for daily needs and a separate, larger generator for full backup power.

Service & Support Trends

1. The Service Ecosystem Now Extends Beyond the Sale

- A successful generator deployment is increasingly dependent on the coordination of the entire installation and support ecosystem.

- A critical path item for many projects is the sourcing of a reliable electrician for installation, a step that must often be completed before a generator purchase can be finalized.

2. A Local Service Footprint Is a Key Differentiator

- Effective and timely support hinges on a strong local presence, which is a major factor in customer relations and long-term service delivery.

- A robust local footprint is a significant advantage, with clients in states like Florida being supported by multiple in-state service offices.

- To provide the most effective service, support inquiries are being strategically routed to the nearest regional representative, ensuring localized expertise.

3. Creative Problem-Solving Defines Modern Customer Support

- Leading support teams now act as consultants, offering creative solutions that address the full scope of a customer’s problem.

- In challenging equipment situations, support can include unconventional solutions, such as offering to buy back the equipment from the customer.

Market Outlook

Today’s market leaders are not just buying equipment, they are investing in certainty. As we look toward the end of the year, we anticipate this focus on strategic, reliable power solutions will only intensify, making expertise and a proven track record more valuable than ever.

Is your operation prepared for the future? Contact the experts at Generator Source to build a resilient power strategy.